Doji Candlestick Pattern

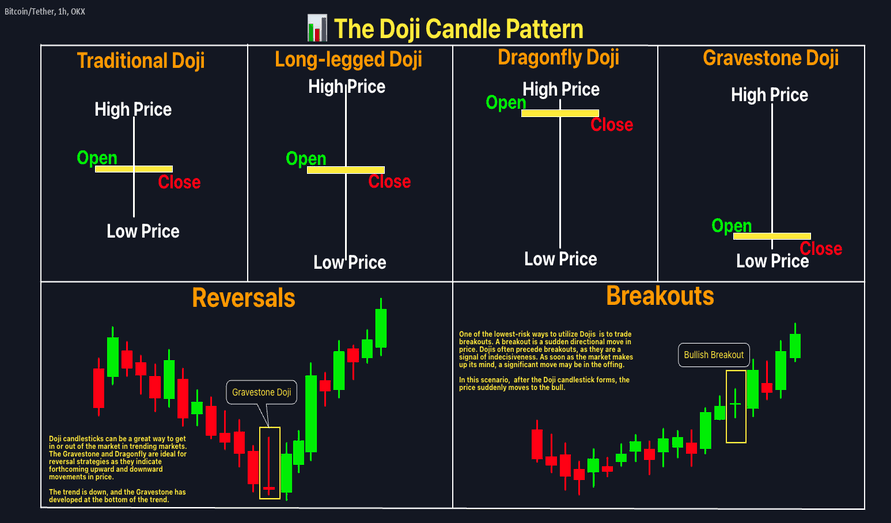

The Doji candlestick pattern is a unique pattern that can signal indecision in the market. It is formed when the opening and closing prices of a security are equal or very close to equal, resulting in a short real body (the body of the candlestick). This creates a cross-shaped appearance, which is why it is sometimes referred to as a “star” pattern.

Meaning of the Doji Pattern:

The Doji pattern signifies a period of indecision between buyers and sellers. It suggests that neither the bulls nor the bears are in control, and the market is unsure of the future direction. This can be a useful indicator for traders, as it can signal a potential reversal or a continuation of the current trend.

Types of Doji Patterns:

There are several different types of Doji patterns, each with its own slightly different interpretation. The most common types are:

- Neutral Doji: This is the most common type of Doji pattern. It has a small real body and wicks of approximately equal length. It suggests indecision in the market, but no clear direction.

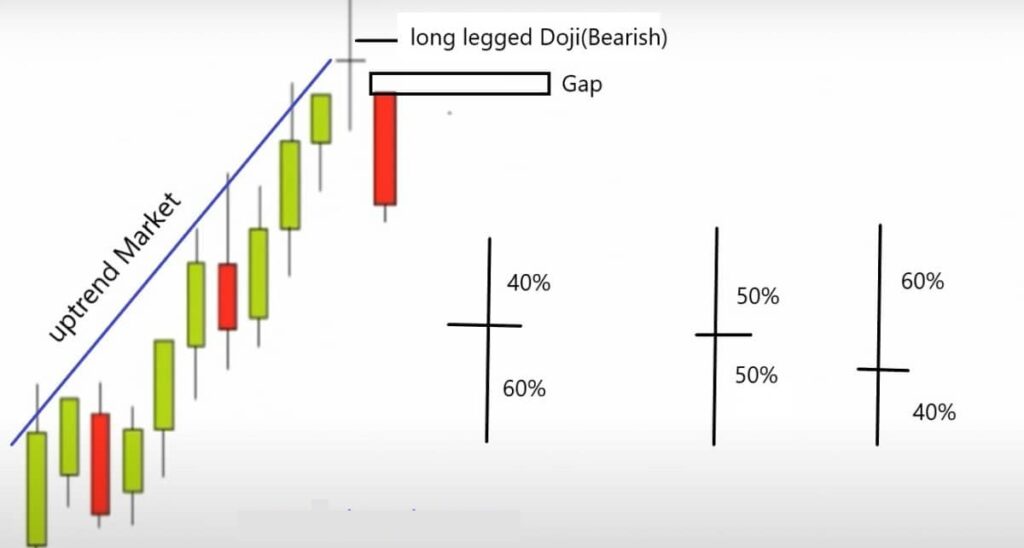

- Long-legged Doji: This pattern has a small real body and long wicks, indicating a wider trading range than the neutral Doji. It can be interpreted as a sign of strong indecision and potential volatility.

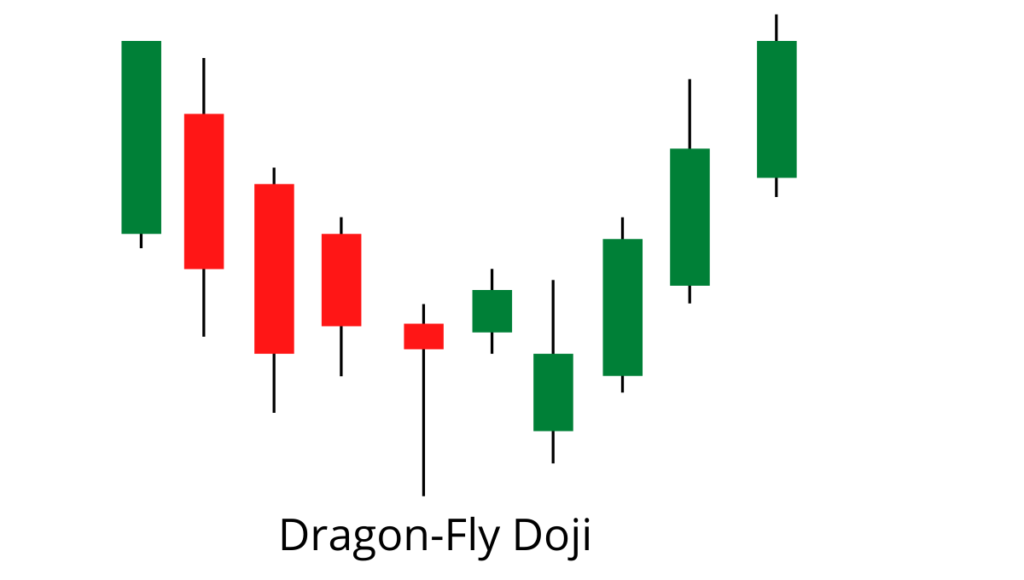

- Dragonfly Doji: This pattern has a small real body and a long lower wick, but no upper wick. It suggests that selling pressure was strong during the period, but buyers were able to push the price back up to close at the opening price. This can be interpreted as a potential reversal signal.

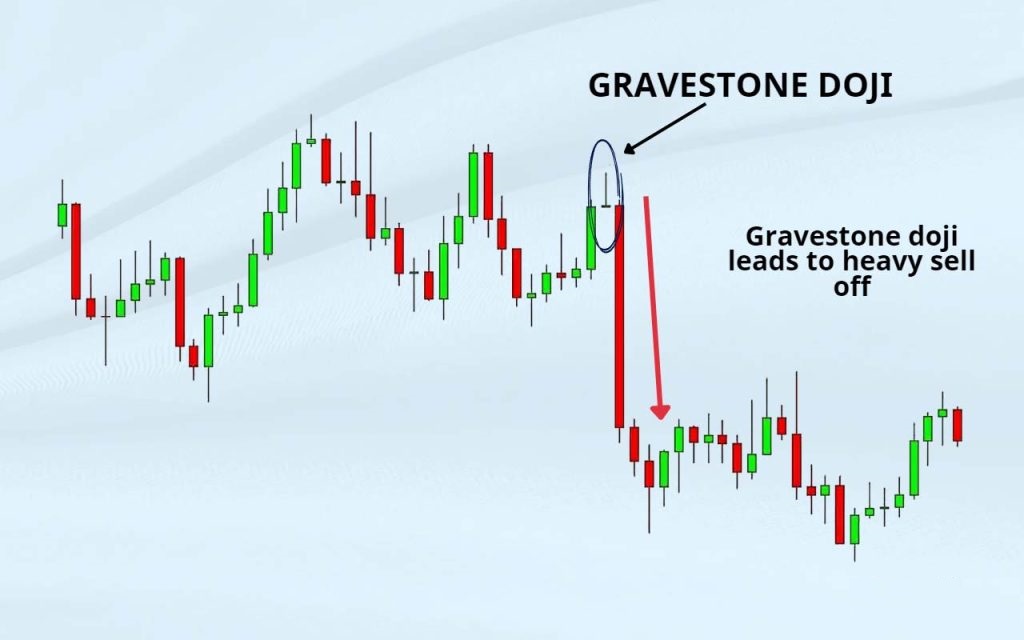

- Gravestone Doji: This pattern is the opposite of the dragonfly Doji. It has a small real body and a long upper wick, but no lower wick. It suggests that buying pressure was strong during the period, but sellers were able to push the price back down to close at the opening price. This can be interpreted as a potential reversal signal.

Trading with the Doji Pattern:

The Doji pattern can be used in a variety of trading strategies. It can be used as a standalone signal, or it can be combined with other technical indicators to confirm a signal. However, it is important to remember that the Doji pattern is not a perfect indicator. It can be misleading, and it should not be used to make trading decisions without considering other factors.

Here are some tips for trading with the Doji pattern:

- Use the Doji pattern in conjunction with other technical indicators to confirm a signal.

- Look for Doji patterns that appear at key support and resistance levels.

- Pay attention to the length of the Doji’s wicks. Long wicks suggest a wider trading range and potential volatility.

- Do not trade based on the Doji pattern alone. Always do your own research and consider other factors before making a trading decision.

Additional Resources:

- Investopedia: https://www.investopedia.com/terms/d/doji.asp

- Cointelegraph: https://www.investopedia.com/terms/d/doji.asp

- Wall Street Mojo: https://candlestickidea.com/doji-candlestick-pattern-kya-hai/

By understanding the Doji candlestick pattern and its different variations, traders can gain valuable insights into the market and make more informed trading decisions.