What is a Hanging Man chart pattern?

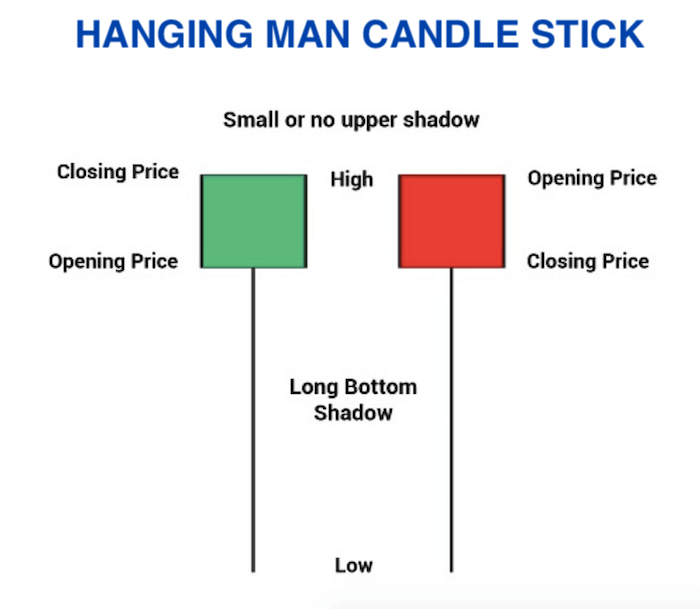

The Hanging Man is a bearish reversal candlestick pattern that indicates a potential shift in momentum after an uptrend. It’s formed by a single candle with a small real body, a long upper shadow, and little or no lower shadow.

How to identify a Hanging Man chart pattern:

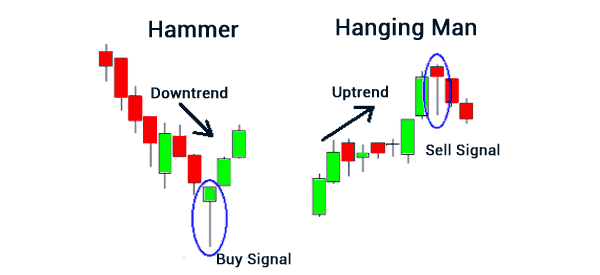

- The Hanging Man appears at the top of an uptrend.

- The real body of the candle is small, typically no more than 30% of the total height of the candle.

- The upper shadow is long, at least twice the length of the real body.

- There is little or no lower shadow.

What does the Hanging Man chart pattern mean?

The Hanging Man suggests that the bulls are losing control of the market. The long upper shadow indicates that buyers pushed the price up early in the trading period but were unable to sustain the momentum. This selling pressure could lead to a reversal of the uptrend.

Confirmation

The Hanging Man is a strong signal, but it is not always accurate. It’s crucial to look for confirmation of the reversal signal before making any trading decisions. Confirmation could come from:

- A bearish follow-up candle, such as a lower close or a bearish engulfing pattern.

- A decline in volume would indicate that the selling pressure is genuine.

- A break of a key support level.

Trading the Hanging Man chart pattern

The Hanging Man is a versatile pattern that can be traded in different ways. Here are a few options:

- Short entry: Sell short when a bearish confirmation signal appears.

- Put options: Buy put options to profit from a decline in the price.

- Protective stop: Place a stop-loss order above the Hanging Man’s high to limit your losses if the pattern fails.

Limitations of the Hanging Man chart pattern

The Hanging Man is not a perfect indicator. It can be misleading if it occurs during a period of high volatility or if it is not confirmed by other technical signals.

Conclusion

The Hanging Man is a valuable tool for traders who want to identify potential trend reversals. However, it’s important to use it in conjunction with other technical analysis techniques and to be aware of its limitations.

Please let me know if you have any other questions.