What is a Shooting Star candlestick pattern?

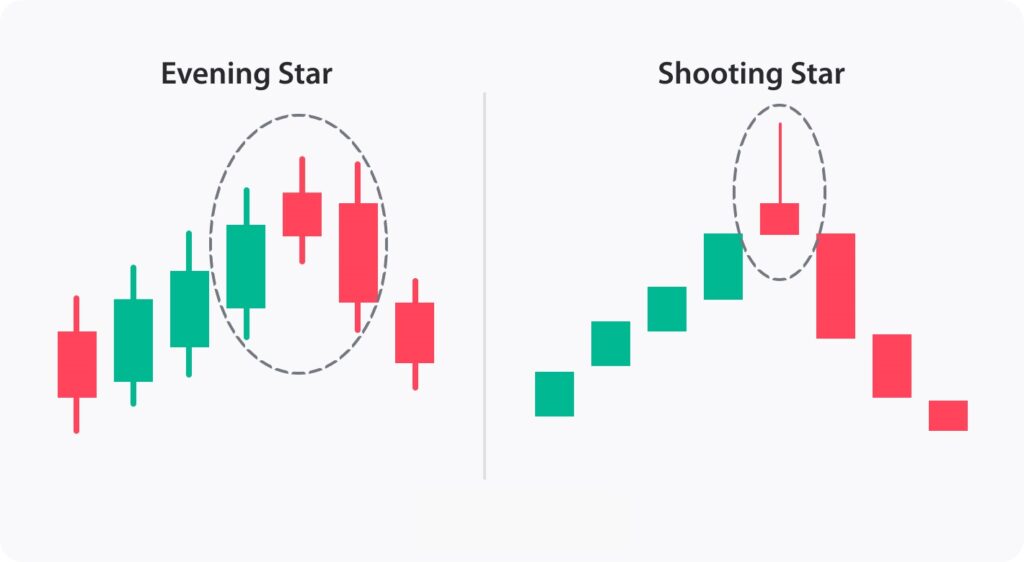

A Shooting Star is a bearish reversal candlestick pattern that typically occurs at the top of uptrends. It is a single-candle pattern that is characterized by a long upper shadow, a small real body, and little or no lower shadow. The upper shadow should be at least two times the size of the real body.

How to identify a Shooting Star candlestick pattern:

- The price opens significantly higher than the previous close.

- The price spikes up to a high that is at least two times the size of the real body.

- The price closes near the open, or slightly lower than the open.

- There is little or no lower shadow.

What does a Shooting Star candlestick pattern mean?

A Shooting Star candlestick pattern is a warning that the uptrend may be losing momentum and that a reversal may be imminent. The long upper shadow indicates that the bulls were able to push the price up significantly, but they were not able to sustain the rally. This suggests that there is selling pressure at higher levels.

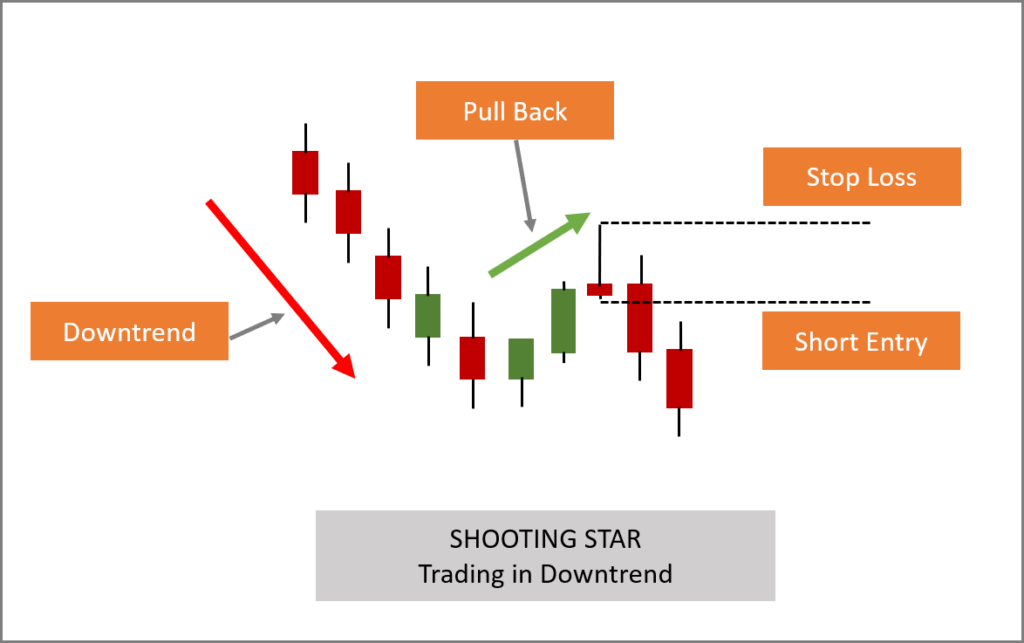

How to trade the Shooting Star candlestick pattern:

Traders typically use the Shooting Star candlestick pattern as a confirmation signal for a bearish reversal. They will often look for other bearish indicators, such as a bearish divergence on the Relative Strength Index (RSI), to confirm the signal. Once they have confirmed the signal, they will typically look to place a sell order.

Here are some additional things to keep in mind when trading the Shooting Star candlestick pattern:

- The Shooting Star candlestick pattern is more reliable when it occurs at the top of a strong uptrend.

- The Shooting Star candlestick pattern is more reliable when it is accompanied by other bearish indicators.

- The Shooting Star candlestick pattern is not a 100% guaranteed signal, and traders should always use it in conjunction with other forms of analysis.

Examples of how to trade the Shooting Star candlestick pattern:

Example 1:

A trader is trading a stock that has been in a strong uptrend. The stock makes a Shooting Star candlestick pattern at the top of the uptrend. The trader also notices that the RSI is showing bearish divergence. The trader decides to place a sell order.

Example 2:

A trader is trading a stock that has been in a choppy trend. The stock makes a Shooting Star candlestick pattern. The trader does not notice any other bearish indicators. The trader decides to wait for more confirmation before placing a sell order.

Conclusion

The Shooting Star candlestick pattern is a useful tool that can help traders identify potential reversals. However, it is important to use the pattern in conjunction with other forms of analysis and to be aware of its limitations.